I am teaching The Spaulding Group’s prep class for the CIPM Principles and Expert level exams this week in Chicago, and it became apparent to me that most of the students in the class were not aware that CFA Institute has a “List of Formulas” document as part of the curriculum that candidates are responsible. 2018 FinQuiz CFA Level 2 Formula Sheet 15. By adjusting terminal value using Scenario analysis = Adj. Scenario 1 × expected E × expected P/E multiple) + (% prob. Our downloadable formula sheets give an overview of every key equation used in the Level II CFA Program curriculum and is nicely organized by topic areas making it easier than ever to learn the mathematical foundations tested on the exam. The CFA Institute has announced that all 2021 exams will continue to reflect the official 2020 curriculum. CFA level 2 comprehensive notes summaries formulas. ( ) Studies, courses, subjects, and textbooks for your search: Press Enter to view all search results ( ).

Level I books, study guides and notes for quick review of textbooks in CFA exam prep

Passing Level I is the first step towards becoming an officiated CFA Charterholder. Do not treat it lightly!

Cfa level 2 formula By not simply meeting minimum legal requirements, the CFA Institute and its members aim to increase public confidence and pin Send you cfa level 123 2018.

CFA Level I material

It is certainly true that Level I is the easiest exam relative to the exam levels II and III. The key word here is relative.

Level I preparation is an arduous task in its own right, and it being the easier of the three should not convince you it will be a cakewalk!

Why you need CFA study guide for Chartered Financial Analyst study?

Consider the scope of the study material - level I: the fundamental ethics and professional standards, as well as a laundry list of financial topics, like equity, economics, portfolio management and so, so much more.

The official CFA curriculum clocks in at approximately 3000 pages of material, so much you could study it for a year and still not master it.

You only have a limited amount of time for Level I exam preparation, so every second counts.

Preparation with FinQuiz CFA exam Level 1 study material can save your time!

While you will need a full and total reading of all official level I textbooks to pass, it is practically impossible to read through textbook twice, let alone read through it enough to absorb all the key concepts.

To excel, you need supplementary materials and study program to guide your focus and efforts for level I.

This is why FinQuiz is such a fantastic tool for serious students. We supplement every LOS of official curriculum with helpful notes, formula sheets, summaries and other CFA study material to ensure a comprehensive understanding of everything you need to know.

Consider just some of what we offer in our Level I study material and download free CFA study material PDF by clicking here.

Question Bank

The Level I exams may be easier, but they are certainly not easy. Official CFA exams are more than just a list of questions: there is specific timing, style and procedure you will have to undergo when taking your exam. That is why we constructed our mock materials to accurately mimic the flow and length of the official exam, so you are fully mentally and emotionally prepared for the actual test. Sitting down to a heaping bowl of exam questions is probably not your favorite dish, but it will get you closer to that charter. We are here to help. Want to learn more? Read: How to remember 90% of what you studied for CFA exam?

Summaries

3000 pages is a lot of material to study, and you only have so much time. To properly study for the CFA, you need to condense the less critical aspects so you can focus on what truly matters. Our summaries are constructed by experienced CFA test-takers and administrators, so that our summations are comprehensive on what will be tested to the minute detail, and relatively light on the less important materials.

Chapter notes

Our notes are the best on the market, bar none. Designed to supplement, not replace, your Level I materials, these notes will reinforce what you need to know so you are more fully prepared for the exam. You would not need extra study guides from anyone else: you will find our notes fully cover it all.

Mock exams

The Level I exams may be easier, but they are certainly not easy. Official CFA exams are more than just a list of questions: there is specific timing, style and procedure you will have to undergo when taking your exam. That is why we constructed our CFA Level 1 mock exam to accurately mimic the flow and length of the official exam, so you are fully mentally and emotionally prepared for the actual test.

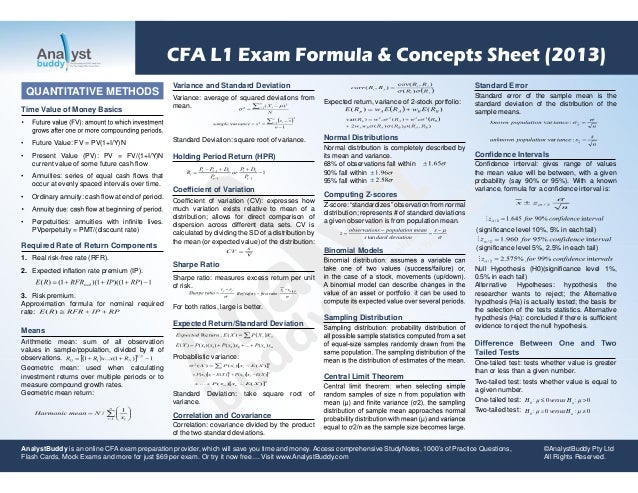

Formula sheet

Level I is notorious for the diverse and complicated formulas you will need to memorize perfectly. Do not despair just yet: our study materials including comprehensive formula sheets, with tools and tricks towards memorizing each and every individual formula. You will find with FinQuiz formula sheet, memorization will be a breeze!

The CFA quant section is the most mathematical and formula driven. It is also important in the first two levels of the CFA exam, representing 12% in Level 1 and 5-10% in Level 2.

In Level 1, candidates are expected to know the basics of quantitative methods. They should be able to interpret the normal distribution and how that relates to quantifying risk, and be very comfortable with covariance, correlation, confidence intervals, and expected value.

The graphical side of the readings (histograms, distributions, cumulative distributions) get tested on a few questions as well.

In level 2, the focus shifts to hypothesis testing which is considerably more complex and is built on the knowledge in Level 1.

Quant Level 1 Syllabus

There are two long study sessions covering the basics of quantitative analysis.

Basic concepts (study session 2)

- The time value of money

- Discounted cash flow application, which is built on the time value of money concepts

- Statistical concepts and market returns

- Probability concepts

Application (study session 3)

- Common probability distribution

- Sampling and estimation

- Hypothesis testing

- Technical analysis

SS3 is considerably more difficult. It is not a particularly long read but there are more end-of-chapter questions than SS2.

CFA Quant Study Tips

1.Build a Good Foundation

Time value of money and DCF is basic for many candidates. It is however very important to truly understand how it works, because it lays the foundation for the equity and fixed-income valuation. Both are big topics in Level 2.

2. Manage your progress

You should aim at mastering the CFA quant section because (1) it is a big section in Level 1, and (2) Knowing Level 1 materials is crucial for tackling Level 2.

Having said that, if you don’t have the background in statistics, it may take up a lot of studying time.

Be conscious of how much time you have spent. If necessary, speed up the reading and save time for practice questions. Don’t let quant derail your study plan.

3. Focus on the logic, not memorizing the formula

Don’t get stressed on the formulas in your first reading, as you are going to forget most of them. Focus on the logic behind the formulas and how the concepts relate to each other.

You can try setting up the formulas in an excel sheet so you can plug in various numbers and see how they work.

4. Watch Khan Academy channel

If there is a concept you don’t understand, check out Khan Academy. This website covers every topic that you can imagine, and it’s all free. Youtube may have similarly helpful videos as well.

5. Practice, practice and practice

This is the same throughout the CFA prep, but especially true for the CFA quant section. Taking more questions help a lot in understanding the concepts and how examiners will test you in the exam.

Practice in quant means getting familiar with how the calculator works as well.

6. Allow time for quick review

As mentioned above, there are lots of formulas in Quant. By the time you finish reading FRA, you would have forgotten 90% of it. Make sure you allow a couple of hours going through those formulas again.

Some readers suggest writing them on flashcards and review them from time to time. Writing notes is time and effort consuming but this method has good pay off in the long run. The CFA exam is a marathon so it’s worth the effort in my opinion.

Conclusion

Cfa Level 1 Formulas Pdf

The CFA quant session could be Goliath to candidates without statistics background. Having said that, most are “light bulb” topics, meaning when the concept clicks (the ah-ha! moment), it will be easy going forward.

For Your Further Reading

- Reference book: Statistics for Management and Economicsby Gerald Keller

Cfa Level 2 Formula Sheet 2018 Printable

Here are more tips on these topic areas: